Big Data in Fintech Companies: Practical Solutions for Quick Deployment

The financial technology landscape has fundamentally shifted. Where traditional institutions once dominated through scale and regulatory moats, nimble fintech companies now compete through intelligent data utilization and rapid innovation cycles. McKinsey’s latest analysis projects fintech revenues reaching $1.5 trillion by 2030—a growth trajectory that outpaces traditional banking by nearly 3x.

This explosive growth isn’t accidental. It’s powered by organizations that have mastered the art of transforming raw data into actionable intelligence at unprecedented speed.

The New Reality: Speed Meets Scale in Financial Services

Today’s financial services leaders face a paradox. They need enterprise-grade data capabilities that traditionally took years to build, but market pressures demand deployment in weeks, not quarters. The companies winning this race aren’t necessarily those with the biggest budgets—they’re the ones making smarter architectural choices and leveraging modern data platforms effectively.

At Blue Orange Digital, we’ve helped numerous financial institutions navigate this challenge by focusing on practical, implementable solutions rather than theoretical frameworks. The key lies in understanding which battles to fight and which shortcuts actually work.

Five Critical Areas Where Data Creates Competitive Advantage

1. Real-Time Transaction Intelligence

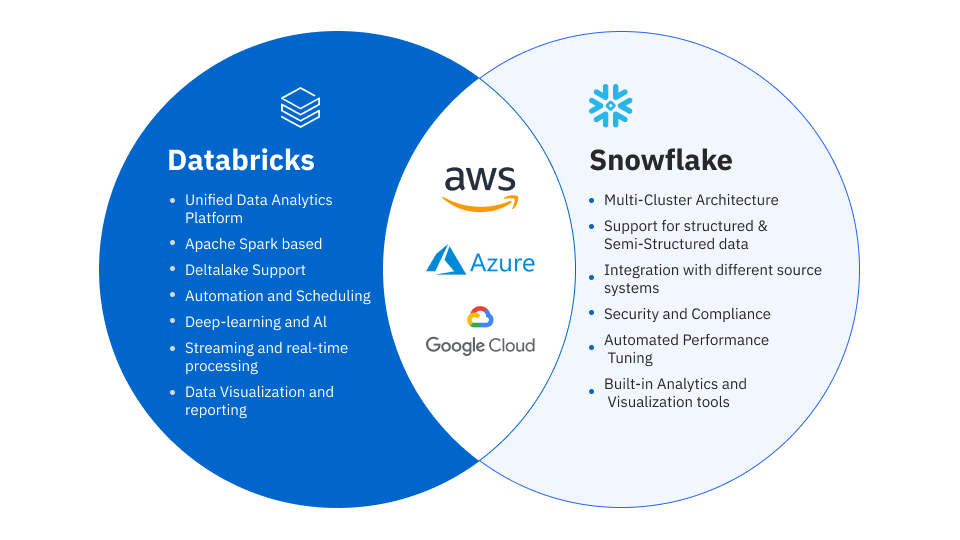

Modern payment processors and trading platforms can’t afford batch processing delays. By implementing streaming analytics on platforms like Databricks, financial firms process millions of transactions in real-time, enabling instant fraud detection and dynamic pricing adjustments.

Consider how Stripe’s Radar system analyzes billions of data points across their network to block fraudulent transactions before they complete. This isn’t futuristic—it’s table stakes for competitive financial services.

2. Predictive Risk Modeling That Actually Works

Traditional credit scoring models rely on limited historical data. Modern lenders incorporate alternative data sources—from utility payment patterns to device metadata—creating more inclusive and accurate risk profiles.

The Association of Certified Fraud Examiners found that organizations using predictive analytics reduce fraud losses by up to 52%. These aren’t marginal improvements—they’re transformative results that directly impact profitability.

3. Hyper-Personalized Customer Experiences

Generic financial products are dying. Customers expect recommendations tailored to their specific circumstances, delivered through their preferred channels. This requires sophisticated segmentation engines that can process behavioral data, transaction histories, and external signals in real-time.

Leading neobanks achieve this through integrated data pipelines that feed machine learning models, creating personalized insights that feel almost prescient to end users.

4. Automated Compliance and Reporting

Regulatory compliance consumes enormous resources at traditional institutions. Smart fintechs automate these processes through well-designed data architectures that maintain audit trails, flag suspicious activities, and generate required reports automatically.

This isn’t about replacing compliance teams—it’s about freeing them to focus on strategic risk management rather than manual data reconciliation.

5. Dynamic Product Development

The ability to rapidly test and iterate on new financial products separates market leaders from followers. This requires flexible data infrastructure that can support experimentation without risking core systems.

Building Your Data Foundation: Practical Architecture Decisions

Cloud-Native vs. Hybrid Approaches

The debate between cloud and on-premise infrastructure is largely settled for new entrants—cloud wins on cost, flexibility, and time-to-market. But established institutions face more complex decisions.

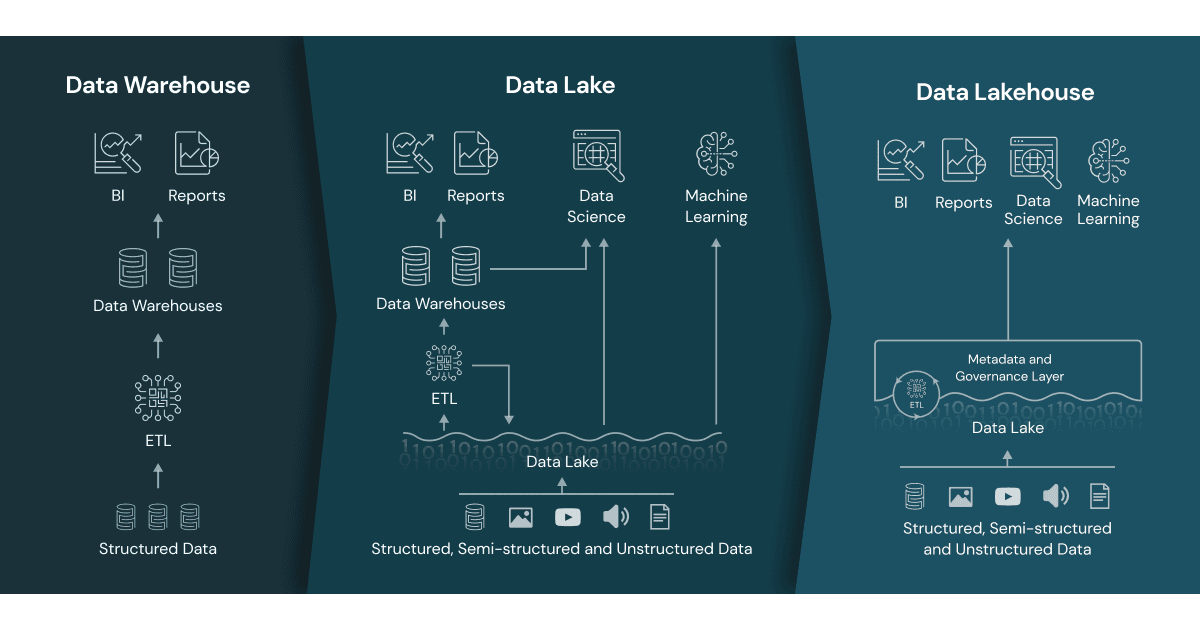

Pure Cloud Strategy: Ideal for startups and digital-first institutions. Platforms like Snowflake provide instant scalability without capital expenditure. According to O’Reilly’s 2025 infrastructure report, 47% of enterprises now pursue cloud-first strategies.

Hybrid Architecture: The pragmatic choice for institutions with significant legacy investments. Keep sensitive core banking data on-premise while leveraging cloud analytics for customer-facing applications.

Edge Computing Integration: Emerging pattern for real-time applications where milliseconds matter, such as high-frequency trading or instant payment verification.

The Build vs. Buy Decision Matrix

Not everything needs custom development. Smart organizations leverage pre-built components where possible:

- Buy: Standard ETL pipelines, data quality tools, visualization platforms

- Build: Proprietary risk models, unique customer segmentation algorithms

- Partner: Specialized compliance modules, fraud detection systems requiring constant updates

Implementation Roadmap: From Concept to Production in 90 Days

Phase 1: Foundation (Weeks 1-4)

Start with a focused business problem that has clear metrics. Popular starting points include reducing fraud false positives, improving loan approval times, or increasing cross-sell rates.

Establish your core data infrastructure using modern platforms. Snowflake for data warehousing paired with Databricks for advanced analytics provides a robust foundation that scales with your needs.

Phase 2: Integration (Weeks 5-8)

Connect critical data sources through automated pipelines. Modern integration platforms can connect to hundreds of data sources through pre-built connectors, eliminating months of custom development.

Implement data quality checks and governance frameworks from day one. Technical debt in data quality compounds quickly and becomes exponentially harder to fix later.

Phase 3: Intelligence Layer (Weeks 9-12)

Deploy initial machine learning models using MLOps platforms that handle versioning, monitoring, and deployment. Start simple—a basic fraud detection model that outperforms rule-based systems proves value quickly.

Create dashboards and automated reports that deliver insights to business users without requiring technical expertise.

Common Pitfalls and How to Avoid Them

The Perfection Trap

Many organizations spend months designing the “perfect” architecture that never gets built. Instead, start with an MVP that solves one specific problem, then iterate based on real-world feedback.

Underestimating Change Management

Technology is only half the equation. Successful implementations require buy-in from business users, proper training, and clear communication about how new capabilities benefit everyone.

Security as an Afterthought

Financial data requires bank-grade security from day one. This means encryption at rest and in transit, role-based access controls, and comprehensive audit logging. The cost of retrofitting security far exceeds doing it right initially.

Ignoring Data Governance

Without clear ownership and quality standards, data initiatives devolve into chaos. Establish data stewardship roles and implement automated quality monitoring from the start.

Measuring Success: KPIs That Matter

Track metrics that directly tie to business value:

- Operational Efficiency: Reduction in manual processing time (target: 40-60% in year one)

- Risk Metrics: Decrease in fraud losses and bad debt write-offs (target: 20-30% improvement)

- Customer Satisfaction: Improved NPS scores and reduced complaint volumes (target: 15-point NPS increase)

- Revenue Impact: Increased cross-sell rates and customer lifetime value (target: 25% improvement in cross-sell)

- Time to Market: Reduced product development cycles (target: 50% faster launches)

The Path Forward: Practical Next Steps

The gap between data-driven leaders and laggards widens daily. But transformation doesn’t require massive upfront investment or multi-year programs. By focusing on specific business problems, leveraging modern cloud infrastructure, and building incrementally, financial institutions can achieve meaningful results in weeks rather than years.

Start with these concrete actions:

- Identify your highest-impact use case where better data could drive immediate value

- Assess your current data maturity honestly—know what you have and what you need

- Choose modern, proven platforms rather than building from scratch

- Partner with specialists who understand both technology and financial services

- Measure everything and iterate based on results, not assumptions

The financial services industry stands at an inflection point. Organizations that successfully harness their data will thrive, while those that don’t risk irrelevance. The good news? With the right approach and modern tools, any financial institution can build world-class data capabilities faster than ever before.

The question isn’t whether to invest in data infrastructure—it’s how quickly you can deploy solutions that drive real business value. In today’s market, speed of implementation often matters more than perfection. Start small, prove value, and scale what works.