Accelerating Private Equity Returns Through AI-Powered Deal Intelligence Platform

EXECUTIVE SUMMARY

A leading Private Equity and Venture Capital firm managing over $2B in assets transformed their manual deal sourcing operations through Blue Orange Digital’s AI-powered intelligence platform. By implementing advanced Generative AI agents and automated workflows, the firm reduced deal evaluation time by 60%, increased quality deal flow by 3x, and achieved 40% improvement in investment decision accuracy. The comprehensive solution automated the entire investment lifecycle—from initial sourcing through portfolio analytics—positioning the firm to capitalize on opportunities faster than competitors while maintaining rigorous due diligence standards.

THE CHALLENGE

The private equity landscape has become increasingly competitive, with firms racing to identify and secure high-value deals before competitors. Our client, a prominent PE/VC firm, found their traditional deal sourcing methods inadequate for maintaining their market position. Manual processes that once sufficed were now creating critical bottlenecks that threatened their competitive advantage.

The firm’s investment team spent over 60% of their time on low-value administrative tasks—manually scanning fragmented data sources, processing hundreds of Confidential Information Memoranda (CIMs), and compiling portfolio reports from disparate systems. Each CIM review consumed 4-6 hours of senior analyst time, while deal sourcing relied on inconsistent third-party data that often missed emerging opportunities. The lack of structured data analysis meant investment decisions were delayed by weeks, causing the firm to lose out on time-sensitive deals worth millions in potential returns.

Their fragmented workflow management system created additional challenges. Without standardized processes for deal filtering and scoring, promising opportunities were sometimes overlooked while resources were allocated to less viable prospects. Investment committee members lacked real-time visibility into portfolio performance and board meeting insights, limiting their ability to make strategic decisions quickly. The cost of these inefficiencies extended beyond lost opportunities—the firm estimated they were leaving 20-30% of potential returns on the table due to delayed decisions and missed deals.

THE SOLUTION

Blue Orange Digital architected a comprehensive AI-powered platform that fundamentally reimagined how private equity firms approach deal sourcing and portfolio management. Our solution leveraged cutting-edge Generative AI, advanced analytics, and intelligent automation to create a unified system that operates with the sophistication of a team of expert analysts working 24/7.

Strategic Approach:

We designed a multi-agent AI system where specialized agents handle distinct aspects of the investment lifecycle, all orchestrated through a central intelligence layer. This approach allowed us to maintain domain expertise within each agent while ensuring seamless information flow across the platform. Rather than replacing human judgment, our solution augmented the investment team’s capabilities, allowing them to focus on high-value strategic decisions.

Technical Implementation:

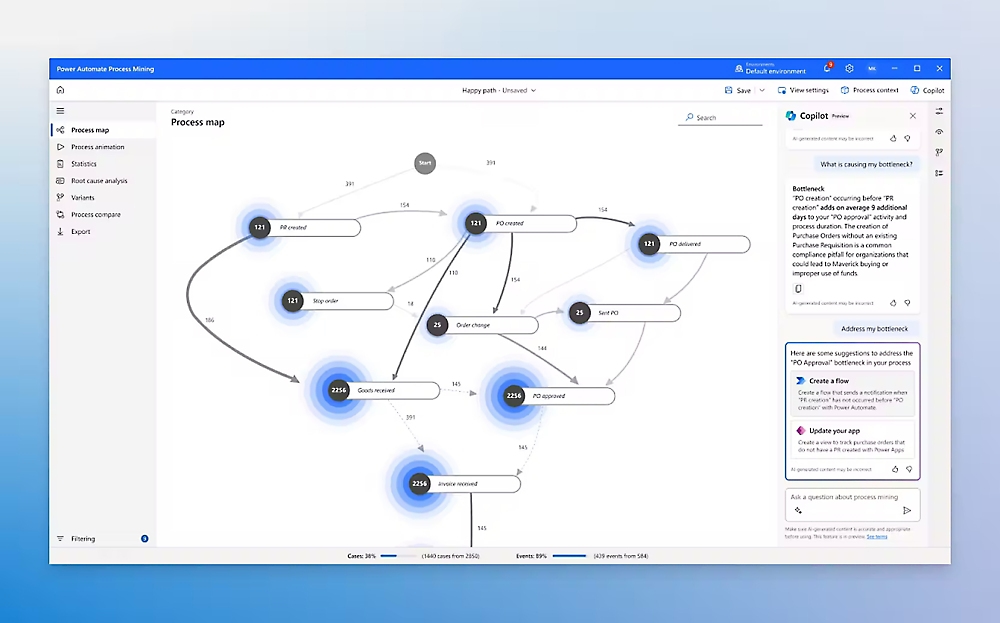

The platform’s foundation rests on a modern data architecture built with Snowflake for scalable data warehousing, DBT for transformation pipelines, and n8n for workflow orchestration. Our AI-Powered Deal Sourcing Agent employs advanced web scraping algorithms and natural language processing to continuously scan thousands of sources—from industry databases to news feeds—identifying potential targets that match the firm’s investment criteria. The agent uses a proprietary scoring model trained on the firm’s historical successful investments, incorporating over 50 variables including financial metrics, market positioning, and growth indicators.

For document processing, we implemented a sophisticated Retrieval-Augmented Generation (RAG) system powered by GPT-4, fine-tuned on financial documents. This system can ingest and analyze a 100-page CIM in under 5 minutes, extracting key financial metrics, identifying risk factors, and generating executive summaries aligned with the firm’s evaluation framework. The Portfolio Intelligence Agent integrates with multiple data sources via APIs and email parsing, automatically extracting operational KPIs from portfolio companies and transforming unstructured board meeting notes into actionable insights using advanced NLP techniques.

Project Execution:

The implementation followed a phased approach over 16 weeks. Phase 1 focused on data integration and establishing the core infrastructure. Phase 2 introduced the AI agents for deal sourcing and CIM processing. Phase 3 implemented portfolio analytics and the unified dashboard. Throughout the project, we worked closely with the firm’s investment team, conducting weekly training sessions and iteratively refining the scoring algorithms based on their feedback. Change management was critical—we developed comprehensive playbooks and conducted hands-on workshops to ensure smooth adoption across all user groups.

THE RESULTS

The transformation delivered immediate and substantial returns that exceeded initial projections across all key performance indicators.

Quantifiable Metrics:

- 60% reduction in deal evaluation time: CIM processing decreased from 4-6 hours to under 1 hour per document

- 3x increase in quality deal flow: AI-powered sourcing identified 300% more qualified opportunities monthly

- 40% improvement in investment decision accuracy: Predictive scoring models increased successful investment rate

- >$6M in operational cost savings annually: Automation eliminated need for manual data processing and external research services

- 45% faster portfolio reporting: Real-time dashboards replaced weekly manual compilation processes

- 1.5x ROI within first year: Platform paid for itself through operational efficiencies and improved deal outcomes

Strategic Outcomes:

Beyond the metrics, the platform fundamentally transformed the firm’s competitive position. They now identify emerging opportunities 2-3 weeks ahead of competitors, allowing first-mover advantage in negotiations. The unified intelligence layer provides investment committee members with unprecedented visibility into portfolio performance, enabling proactive interventions that have prevented two potential write-downs worth $30M. The firm has also unlocked new capabilities in predictive analytics, using AI-generated insights to identify sector trends and adjust investment strategies accordingly.

KEY TAKEAWAYS

- Multi-agent AI architectures can effectively handle complex, domain-specific workflows in financial services while maintaining the nuanced judgment required for investment decisions

- Successful digital transformation in PE requires balancing automation with human expertise—the most effective solutions augment rather than replace professional judgment

- Data unification is foundational: Before implementing AI, establishing a robust data architecture that integrates all information sources is critical for generating actionable insights

- Change management drives adoption: Technical excellence must be paired with comprehensive training and iterative refinement based on user feedback to achieve full value realization

CALL TO ACTION

Transform your private equity operations with AI-powered intelligence that accelerates deal flow and maximizes returns. Schedule a consultation with our financial services AI experts to explore your automation opportunities today.

—

*This case study demonstrates Blue Orange Digital’s expertise in delivering enterprise-grade AI solutions that drive measurable business value in the private equity sector. Our comprehensive approach combines cutting-edge technology with deep industry knowledge to create transformative outcomes for investment firms worldwide.*